The week begins with an effort to put on a positive, "yes we can" attitude. There may be some lingering, ongoing economic concerns and domestic issues, but the sense is that they can be addressed and turned around. Competing with this resolve to look at the bright side, is a background of destabilizing factors, some of which comes from outside the U.S. People begin to get agitated and anxious as the week goes on. Midweek could even see a "mild panic" or moment of passion (strong emotions), as a general sense of increasing vulnerability begins to take hold By week's end, risk aversion is becoming more pronounced, and markets are getting more decidedly bearish. People have fixed ideas and opinions of "the facts," and are more willing to talk about them. Protests and demonstrations are on the increase.

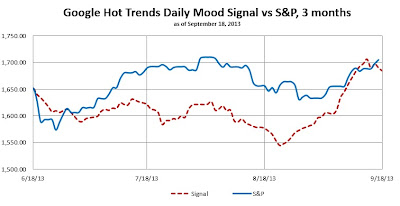

Analysis of U.S.-China relations shows China posturing in a more aggressive tone near June 18.