after market update: actual S&P -11.6 The market was moderately down, in line with social mood signals. When the disaster signal peaks indicating a U.S. tragic event is imminent, we will announce that. Hopefully, it has nothing to do with the upcoming Superbowl this weekend.

Note: data for U.S. social mood are scores in eight MoodCompass categories of Google Hot Trends, data for news are scores of top Google U.S. news stories. Scores are converted to 4 inputs to the Market Mood Model. The output is a conversion of mood data to estimated S&P point change. Stock market data source: Google Finance. This is posted as a public service, and to enhance exposure to our research. It is not intended to be trading advice

(click to enlarge)

- - -

Overview: Collective mood shows aggression, and perceptions of deterioration. Mood signals for the day indicate a moderate decline in the markets is likely. A U.S. disaster or major tragic event is a few days away (see 28 Jan. post). The curve we have been waiting to top is showing signs of peaking, but has not yet turned down. When it does, the anticipated event becomes imminent (within a day or two).

Near Term: Global mood trends imply a profound transformation in the global landscape taking place in the background. It may be another few days to a few weeks to know all that this is pointing to. The social mood trend had been turning down sharply, but after briefly bouncing off support has been scraping along it (see Google trends chart below).

Long Term: Collective mood has been in a many month long process of topping. Long term indicators are flashing "caution," yet there is no definitive signal that a major market shift is imminent. The impact of human and natural disasters of late has been relatively low, but the trend is toward increasing impact. Over time, this may wear on both mood and socioeconomic stability.

Today's Signals: -7.3 from Google Hot Trends, -2.1 from Themes in the News. The projected stock market change for today is shown in the chart below.

(click to enlarge)

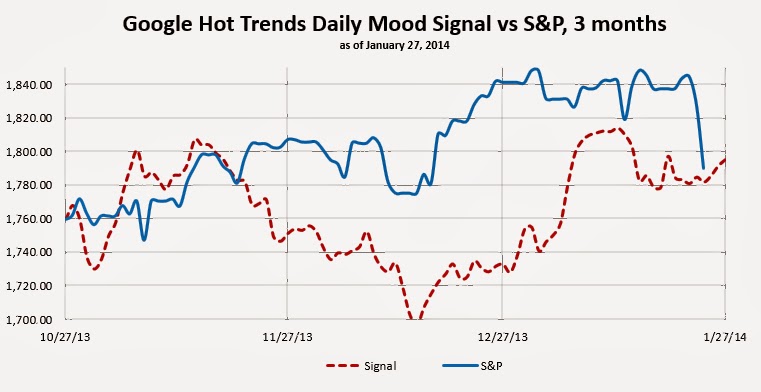

Mood signals from Google Hot Trends: On a daily basis, markets tend to follow social mood more often than not. Overall, social mood trend changes usually precede market trend changes.

(click to enlarge)

Mood signals from themes in the news: News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)