As we await more information about a tragic event that should strongly impact the U.S. any day now (signal indicates most likely timeframe August 1-8, see previous post), the stock market is indicating strong bias toward a sharp sell-off. In addition, today's social mood is showing a shift toward "panic." Something big is brewing. The chart below shows how the stock market has been generally in the same spot for three weeks, while social mood has lead the way steadily down (mood most often leads the market's direction).

Expectations of news themes and stock market movement based on social mood patterns. Research spanning two decades converting social mood information into numerical data is the foundation of the material in this blog. Top internet search trends are scored daily in eight mood factors. The Market Mood Model converts those numbers into expected changes in the stock market, gold, crude oil, and the U.S. Dollar. Presented here is an analysis of the mood patterns and implications for the markets.

Showing posts with label panic. Show all posts

Showing posts with label panic. Show all posts

Tuesday, July 29, 2014

Sunday, July 20, 2014

Time to Panic?

We've been watching the setup develop for months of what has turned out to be a long and painful process, as the world fights to hold on to a sense of growth, expansion, and/or aggression (the alternatives being contraction, depression, and/or despair). We called the first chapter of "World in Crisis" which we then discovered included the beginnings of the Ukraine crisis, a missing Malaysian airliner, and a Korean ferry disaster. Part II of this "World in Crisis" phenomenon saw ISIS take parts of Iraq and Syria, eruption of conflict with Israel/Gaza, further escalation in Ukraine, and another downed Malaysian aircraft with all aboard lost. Part III is nearing.

There has been a steady negative social mood trend for two weeks. Intraday movement (volatility) has begun to increase in the stock market, yet markets have managed to stay nearly flat. Pressure is leaning on the markets for a 3% drop, just to catch up to where social mood has recently deteriorated to. The grand finale we have been watching for in the recent series of world events is not yet here, but as said previously, a drop in the market should be a clear signal that it's getting close. The next few days could be quite informative.

There has been a steady negative social mood trend for two weeks. Intraday movement (volatility) has begun to increase in the stock market, yet markets have managed to stay nearly flat. Pressure is leaning on the markets for a 3% drop, just to catch up to where social mood has recently deteriorated to. The grand finale we have been watching for in the recent series of world events is not yet here, but as said previously, a drop in the market should be a clear signal that it's getting close. The next few days could be quite informative.

Labels:

crash,

Gaza,

global,

Iraq,

israel,

Malaysia,

noetic,

panic,

social mood,

socionomic,

stock market,

Ukraine,

violence

Monday, May 5, 2014

World in Crisis, Part II

In the previous post, we summed up the latest on this complex global crisis pattern that began in late February. The Ukraine crisis kicked it off, then the Malaysian jet disappearance made headlines for weeks. The Korean ferry sunk, killing hundreds. In the U.S. there were late winter storms, killer tornadoes, and a barrage of news stories of people "losing it" and shooting people.

It was discussed that with all of the angst and distress, globally, and within the U.S. that these events appeared to be of the type that signal the main event yet to come-- precursor events. We expected the "disaster signal" (see 1st chart below) to stay above the line drawn near the bottom right of the chart and to at some point turn up. Through all these weeks, this signal line has been churning away near that baseline, neither clearly going up toward a new set up, nor falling down in release. It has been a difficult time of transition for many, yet the big impact for the U.S. has not yet appeared.

It was discussed that with all of the angst and distress, globally, and within the U.S. that these events appeared to be of the type that signal the main event yet to come-- precursor events. We expected the "disaster signal" (see 1st chart below) to stay above the line drawn near the bottom right of the chart and to at some point turn up. Through all these weeks, this signal line has been churning away near that baseline, neither clearly going up toward a new set up, nor falling down in release. It has been a difficult time of transition for many, yet the big impact for the U.S. has not yet appeared.

(click to enlarge)

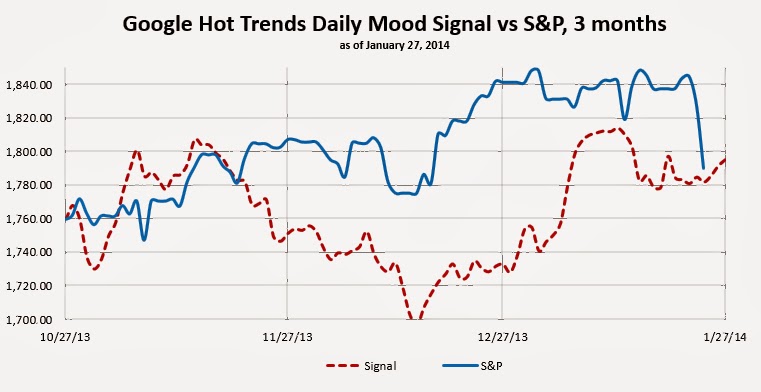

While there is not yet a clear indication that the "grand finale" is imminent, there is a clue from social mood and the stock market that it is becoming quite close, likely within a few weeks away. The chart below shows expected stock market movement derived from social mood (Google Hot Trends) versus actual stock market movement. The two lines on this chart are usually pretty much in sink. What this is telling us is two things: 1) The market trend is up, and in line to continue to new highs; and 2) The market is not able to go much higher than it currently is without first making a sharp drop down to at least the 1700-1750 area (the social mood signal dropped there in March, but the market didn't follow along-- it can't get away with that indefinitely). In other words, an 8 to 10 percent correction is required for the market to continue much higher than where it is right now (S&P 1884). If by chance, markets continue to eek out another 2 percent (1922-ish), the drop will need to be that much greater (10 to 12 percent).

(click to enlarge)

According to Robert Prechter's research in Socionomics, the big events tend to come near market bottoms. Tomorrow's (Tuesday's) daily mood signal is showing a dip. Is this the beginning of the drop toward the 1700s? Will tomorrow be the next step closer to this grand finale still a few weeks away (before the market returns to an uptrend)? If not, we will keep watching for the next indicator.

Wednesday, March 5, 2014

Latest Info on Global / U.S. Crisis: 6-13 March 2014

Early on 28 February, we posted about an imminent Global crisis that would strongly impact the U.S. and its people. Hours later, the Ukraine crisis began. The latest info shows that the U.S. impact from this or additional events will show up as soon as tomorrow. This could be the beginnings of the greatest crisis the U.S. has faced in years.

This summarizes the available information from social mood patterns on this upcoming crisis:

1) The likely timeframe is March 6-13. 2) Although dramatic in effect on the U.S. it does not likely involve large U.S. casualties like most "disasters." 3) The social mood configuration shows a rising risk of panic. 4) The category of event is MoodCompass type NE which would usually show up as a) an economic disaster, b) an "attack" (i.e. a perceived "victimization") from a geopolitical entity, or c) if a natural disaster, a winter storm. 5) There is little chance of it being a natural disaster. 6) The precipitating cause is most likely an international disaster or crisis, meaning it could involve further fallout from the Ukraine crisis.

The top chart below shows the relatively low estimated U.S. fatalities of this "disaster." For this reason, as well as the indication of it originating outside of the U.S., we are referring to it as a "crisis." If the second chart is looked at carefully, especially beginning with the Boston Marathon event, the pattern can be observed which makes this crisis appear especially serious.

This summarizes the available information from social mood patterns on this upcoming crisis:

1) The likely timeframe is March 6-13. 2) Although dramatic in effect on the U.S. it does not likely involve large U.S. casualties like most "disasters." 3) The social mood configuration shows a rising risk of panic. 4) The category of event is MoodCompass type NE which would usually show up as a) an economic disaster, b) an "attack" (i.e. a perceived "victimization") from a geopolitical entity, or c) if a natural disaster, a winter storm. 5) There is little chance of it being a natural disaster. 6) The precipitating cause is most likely an international disaster or crisis, meaning it could involve further fallout from the Ukraine crisis.

The top chart below shows the relatively low estimated U.S. fatalities of this "disaster." For this reason, as well as the indication of it originating outside of the U.S., we are referring to it as a "crisis." If the second chart is looked at carefully, especially beginning with the Boston Marathon event, the pattern can be observed which makes this crisis appear especially serious.

(click to enlarge)

(click to enlarge)

Monday, January 27, 2014

Rising Aggression: Outlook 27 January '14

after market update: actual S&P -8.7. Markets were down again, but have reached the 1780 S&P area, which social mood signals indicate as a support area (see near term below). Markets are likely to hover around and try to bounce off this area at least for a moment.

(click to enlarge)

- - -

Overview: Collective mood shows a sharp rise in global aggression and willingness to take action, along with rising risk of a panic response. Social mood signals give near term market support near S&P 1780. Mood signals for the day indicate a moderate rally is likely. Markets are extremely oversold relative to daily social mood signals, yet may continue to be so until reaching support.

Near Term: Global mood trends show rising aggression and willingness to take action, along with rising risk of a panic response. The social mood trend had been turning down, but has reached support. This may pause or reverse the downtrend in the near term. The market equivalent of this mood signal area is S&P 1780.

Long Term: Collective mood has been in a many month long process of topping. Long term indicators are flashing "caution," yet there is no definitive signal that a major market shift is imminent. The impact of human and natural disasters of late has been relatively low, but the trend is toward increasing impact. Over time, this may wear on both mood and socioeconomic stability.

Today's Signals: +13.5 from Google Hot Trends, +4.5 from Themes in the News. The projected stock market change for today is shown in the chart below.

(click to enlarge)

Mood signals from Google Hot Trends: On a daily basis, markets tend to follow social mood more often than not. Overall, social mood trend changes usually precede market trend changes.

(click to enlarge)

Mood signals from themes in the news: News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

Friday, January 24, 2014

Big Bad News this Weekend?

(click here to enlarge)

(click here to enlarge)

The market is now sharply dropping. According to the social mood signal (see #2 in Google Hot Trend chart), it should pause at least briefly in the S&P 1780 to 1800 area. The news signal, on the other hand, has not yet shown its sharp drop. That may come as soon as this weekend (see #2 in News chart). It's possible that a "big bad news story" could accompany this. It is also possible, that a relieving news story occurs relatively soon that leads to the market pause or bounce which is also right around the corner.

Please note that these are preliminary charts and were produced with data available as of January 24. The official January 27 chart is not released until midnight (E.T.) of January 27. Because of this we will not yet comment on area #3 in the Google Trends chart.

Don't miss out on seeing our global and U.S. overview for the year 2104 at: http://moodcompass-world.blogspot.com/2014/01/2014-global-and-us-overview.html

Wednesday, January 15, 2014

Outlook16 January '14

after market update: actual S&P -2.5. Markets retreated from highs in a mostly sideways motion in line with social mood. Markets remain highly overbought relative to collective mood signals.

(click to enlarge)

- - -

Overview: Collective mood shows rising uncertainty and ambiguity. Mood signals for the day indicate a market that has little room left to rise, and markets are highly overbought relative to social mood. In other words, it wouldn't take much of a nudge to initiate a sharp sell-off.

Near Term: Global mood trends show sharply rising uncertainty and ambiguity. Near term social mood trend had been pushing against a "ceiling"(see Google Hot Trends chart below) but is now in process of turning down sharply.

Long Term: Collective mood has been in a many month long process of topping, but there is no sign that a major market shift is imminent. The impact of human and natural disasters of late has been relatively low, but the trend is toward increasing impact. Over time, this may wear on both mood and socioeconomic stability.

Today's Signals: +3.0 from Google Hot Trends, +0.2 from Themes in the News. The projected stock market change for today is shown in the chart below.

(click to enlarge)

Mood signals from Google Hot Trends: On a daily basis, markets tend to follow social mood more often than not. Overall, social mood trend changes usually precede market trend changes.

(click to enlarge)

Mood signals from themes in the news: News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

Tuesday, January 14, 2014

Panic or Disaster Imminent? - Outlook 15 January '14

after market update: actual S&P +9.5. Markets rallied to new record highs, and are now seriously overbought relative to collective mood signals which have turned sharply down.

(click to enlarge)

- - -

Overview: Collective mood shows rising perceptions of deterioration or disaster. Themes in the news reflect a perception of instability and uncertainty. Mood signals for the day indicate a wide market range possible, from little changed to a sharp sell-off.

Near Term: Global mood trends show sharply rising instability and perceptions of deterioration or destruction. Near term social mood trend had been pushing against a "ceiling"(see Google Hot Trends chart below) but is now in process of turning down sharply.

Long Term: Collective mood has been in a many month long process of topping, but there is no sign that a major market shift is imminent. The impact of human and natural disasters of late has been relatively low, but the trend is toward increasing impact. Over time, this may wear on both mood and socioeconomic stability.

Today's Signals: -19.8 from Google Hot Trends, +4.4 from Themes in the News. The projected stock market change for today is shown in the chart below.

(click to enlarge)

Mood signals from Google Hot Trends: On a daily basis, markets tend to follow social mood more often than not. Overall, social mood trend changes usually precede market trend changes.

(click to enlarge)

Mood signals from themes in the news: News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

Subscribe to:

Posts (Atom)