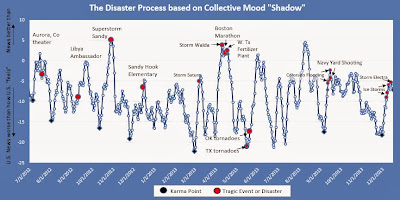

On 24 July, we announced a disaster or tragic event of high impact to the United States was near and most likely to occur between August 1-8, 2014. Also, that more information would be available in the days ahead as to the type of event that was anticipated.

The shift in social mood points to a collective desire to shift *away* from global violence as people become concerned with new types of threats. Some of these new types of concerns, such as disease and economic issues have already begun to surface as Ebola makes headlines and market volatility spikes. Environmental tragedies and natural events that relate to water or fluid such as severe storms, flooding, a tsunami, or volcanic eruptions (lava) may also be a part of this cluster.

At this time, we can say the following about likely events of this period:

1) The bulk of the destructive components of these events should be international (non-U.S.) in origin.

2) There could be a significant economic component or impact to the U.S.

3) The event or series of events should dominate U.S. conversation and air-wave time for days if not weeks.

For more info on The MoodCompass Project, see http://moodcompass.com.

The shift in social mood points to a collective desire to shift *away* from global violence as people become concerned with new types of threats. Some of these new types of concerns, such as disease and economic issues have already begun to surface as Ebola makes headlines and market volatility spikes. Environmental tragedies and natural events that relate to water or fluid such as severe storms, flooding, a tsunami, or volcanic eruptions (lava) may also be a part of this cluster.

At this time, we can say the following about likely events of this period:

1) The bulk of the destructive components of these events should be international (non-U.S.) in origin.

2) There could be a significant economic component or impact to the U.S.

3) The event or series of events should dominate U.S. conversation and air-wave time for days if not weeks.

For more info on The MoodCompass Project, see http://moodcompass.com.