Expectations of news themes and stock market movement based on social mood patterns. Research spanning two decades converting social mood information into numerical data is the foundation of the material in this blog. Top internet search trends are scored daily in eight mood factors. The Market Mood Model converts those numbers into expected changes in the stock market, gold, crude oil, and the U.S. Dollar. Presented here is an analysis of the mood patterns and implications for the markets.

Showing posts with label model. Show all posts

Showing posts with label model. Show all posts

Thursday, August 13, 2015

Monday, January 13, 2014

2014 Global and U.S. Overview

Projecting forward the cycles of collective mood and perception for 2014 gives us the following likely scenarios (at the end of this post is a link to download more complete info).

Global:

March/April –Fuel Prices Soar on Iranian Nuke issue

May/June –Uncertain Response Inflames Israel

August –Iran Deal Proposed (Hillary-style)

September –CPI Remains High, Markets Choppy

October –Incumbents Worried

United States Government:

Primary themes of bickering, inaction, indecision, and confusion

March/April - U.S. government in crisis mode

2014 and You -- see the presentation pdf

Feel free to download your copy of the MoodCompass team's overview of 2014 here.

- - -

Update 16 January '14 A Bill Stokes Debate, and Doubt, on Iran Deal

Global:

March/April –Fuel Prices Soar on Iranian Nuke issue

May/June –Uncertain Response Inflames Israel

August –Iran Deal Proposed (Hillary-style)

September –CPI Remains High, Markets Choppy

October –Incumbents Worried

United States Government:

Primary themes of bickering, inaction, indecision, and confusion

March/April - U.S. government in crisis mode

2014 and You -- see the presentation pdf

Feel free to download your copy of the MoodCompass team's overview of 2014 here.

- - -

Update 16 January '14 A Bill Stokes Debate, and Doubt, on Iran Deal

Labels:

2014,

crisis,

economy,

fed,

forecast,

global,

iran,

israel,

middle east,

model,

prediction,

social mood,

united states

Thursday, January 2, 2014

Avoiding Weakness: Outlook 3 January '14

after market update: actual S&P -0.68. Much of the day was a hard attempt to stay positive, but the anticipated mild rally didn't hold until the end of the day. Market's are now oversold relative to social mood.

(click to enlarge)

- - -

Overview: Collective mood reflects global trends of aggression and violence, but almost as a desperate attempt to ward off perceptions of weakness or vulnerability. Mood signals for the day indicate a mild market rally is likely.

Near Term: Global trends of aggression and violence should continue to be prominent. Markets may get a boost from a collective adrenaline rush. Near term social mood trend is positive.

Long Term: Collective mood is has not been keeping pace with the market sugar high, but there is no sign that a market shift is imminent. The impact of human and natural disasters of late has been low, but the trend is toward increasing impact. Over time, this may wear on both mood and socioeconomic stability.

Today's Signals: +4.1 from Google Hot Trends, +3.7 from Themes in the News. The projected stock market change for today is shown in the chart below.

(click to enlarge)

Mood signals from Google Hot Trends: On a daily basis, markets tend to follow social mood more often than not. Overall, social mood trend changes often precede market trend changes.

(click to enlarge)

Mood signals from themes in the news: News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

Wednesday, January 1, 2014

Economic Issues Rising: Outlook 2 January '14

after market update: actual S&P -16.4. Today's sell-off was in line with collective mood's signal and indication of rising global economic issue. Markets are now slightly oversold relative to mood in the short term. Will that mean a bounce tomorrow?

(click to enlarge)

- - -

Overview: Collective mood reflects global trends of aggression and violence, but almost as a desperate attempt to ward off perceptions of weakness. There's an elevated global risk for economic issues to surface. Mood signals for the day indicate a moderate market sell-off is likely.

Today's Signals: -8.7 from Google Hot Trends, -4.3 from Themes in the News. The projected stock market change for today is shown in the chart below.

(click to enlarge)

Mood signals from Google Hot Trends: On a daily basis, markets tend to follow social mood more often than not. Overall, social mood trend changes often precede market trend changes.

(click to enlarge)

Mood signals from themes in the news: News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

Labels:

2014,

crash,

forecast,

January,

model,

noetic,

social mood,

socionomic,

stock market,

top

Sunday, December 15, 2013

More Info on the Next U.S. Tragedy

The latest information suggests the next big U.S. tragedy will be early this week. One week ago, the latest information showed the next big U.S. tragedy was days away. On the 10th, it appeared imminent. Friday's shooting at Arapahoe High School could have been the next disaster, but it wasn't. It was a tragedy, but did not resolve the pattern that has been developing in collective mood. There is something else still likely to show up.

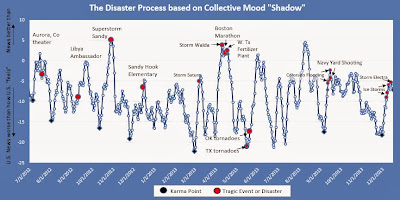

Below is the latest graph of social mood relative to U.S. news (an update to what was presented last week). Storm Electra has been added to the chart.

Below is the latest graph of social mood relative to U.S. news (an update to what was presented last week). Storm Electra has been added to the chart.

(click to enlarge)

Notice what has happened to the pattern. This line had appeared to be peaking near December 10th as the ice storms were completing. This would mean that a major U.S. tragic event was right around the corner. The Arapahoe shooting happened immediately after this apparent peak, but this line then started to climb again. The added segment over this past week, with Storm Electra added, shows a peaking had not yet occurred... until now. So, again, as was said in the original post on this event, if the pre-disaster pattern that can be clearly seen with the Boston Marathon event, and the recent Navy Yard shooting, continues to hold true, then America is only days away from its next big tragedy. Sunday, December 8, 2013

The Next American Tragedy... A Few Days Away?

America's next big tragedy may be only a few days away. This has been detected by observing changes in social mood, and in the divergence between themes in the news and how people collectively are feeling. For more details on how this is detected, see Disasters: Society's Shadow. For more details on where America is now, and this particular alert, keep reading.

The chart below is one of the ways we watch the changes in social mood relative to the news. A pattern emerged prior to every major tragic U.S. event since July 2012. You will see one of the black dots, labeled Karma Point, followed by a red dot, labeled Tragic Event or Disaster. The exception to this is that immediately following the very impactful Boston Marathon event and out through September of this year, there was a disruption in the pattern.

If the previous pattern has returned, as appears from the Navy Yard shooting in September, then America is days away from its next big tragedy. We will be able to discover within a few days, if this is true, or if there is some unidentified new pattern (or no pattern) in play. Another interesting feature that has been noticed in the last few disaster clusters is a possible relationship between stormy weather and the immediately following tragic events.

In April 2013, immediately preceding the Boston Marathon event, was a disruptive and damaging storm, and this line on the graph peaked.

In September 2013, immediately preceding the Navy Yard Shooting, there was a major flooding event in Western Colorado.

Now, in December 2013, after the prerequisite black dot on the graph (Karma Point), there are disruptive and damaging ice storms. The big question is, does this line now peak, with a major U.S. tragedy immediately afterwards? We will know in a few days.

The chart below is one of the ways we watch the changes in social mood relative to the news. A pattern emerged prior to every major tragic U.S. event since July 2012. You will see one of the black dots, labeled Karma Point, followed by a red dot, labeled Tragic Event or Disaster. The exception to this is that immediately following the very impactful Boston Marathon event and out through September of this year, there was a disruption in the pattern.

If the previous pattern has returned, as appears from the Navy Yard shooting in September, then America is days away from its next big tragedy. We will be able to discover within a few days, if this is true, or if there is some unidentified new pattern (or no pattern) in play. Another interesting feature that has been noticed in the last few disaster clusters is a possible relationship between stormy weather and the immediately following tragic events.

In April 2013, immediately preceding the Boston Marathon event, was a disruptive and damaging storm, and this line on the graph peaked.

In September 2013, immediately preceding the Navy Yard Shooting, there was a major flooding event in Western Colorado.

Now, in December 2013, after the prerequisite black dot on the graph (Karma Point), there are disruptive and damaging ice storms. The big question is, does this line now peak, with a major U.S. tragedy immediately afterwards? We will know in a few days.

Friday, October 4, 2013

Mood and Market data review Week Ending 4 Oct '13

How did the Market Mood Model do this past week?

Day Posted Forecast Actual S&P Hypothetical P/L in S&P points

9/30 Sharply down to unchanged -0.6% 10.2

10/1 Slightly down +0.8% -13.5

10/2 Down and volatile -0.1% 1.3

10/3 Unchanged to down sharply -1.0% 16.5

10/4 Unchanged to down sharply +0.7% -11.9

Total for the week: -0.2% or -2.6 pts +2.6 pts

Each forecast this week was down. The S&P was down 3 days and up two. S&P was nearly unchanged at -2.6 points. The posted forecasts yielded a 2.6 point win.

Looking at the midpoint of the model's forecast range vs. the actual stock market for the week:

Day Posted Forecast Actual S&P Hypothetical P/L in S&P points

9/30 Sharply down to unchanged -0.6% 10.2

10/1 Slightly down +0.8% -13.5

10/2 Down and volatile -0.1% 1.3

10/3 Unchanged to down sharply -1.0% 16.5

10/4 Unchanged to down sharply +0.7% -11.9

Total for the week: -0.2% or -2.6 pts +2.6 pts

Each forecast this week was down. The S&P was down 3 days and up two. S&P was nearly unchanged at -2.6 points. The posted forecasts yielded a 2.6 point win.

Looking at the midpoint of the model's forecast range vs. the actual stock market for the week:

Tuesday, September 10, 2013

Trend Change in News and Markets, Could be Today or Tomorrow: 10 Sept '13

after market update: actual S&P +12.28 (0.73%)!

- - -

Overview: Today's mood and news signal show a sense of continued positive developments. However, signal momentum indicates a trend change is likely either today or tomorrow. Markets could rally up to 0.7% today, but it is uncertain whether they will hold their gains through day's end.

Near term outlook: The social mood pattern corresponds with directed action and self-sacrifice for group goals. Common news events associated with the current pattern are related to increased terrorist activity, violent protests, fires or events reflecting themes of confusion or surprise. Natural events associated with this pattern are earthquakes and high winds.

Longer term outlook: The social mood trend may be turning up.

Today's Market Outlook is Up, but with increased risk of mid-session reversal. Both the social mood signal and news signal are moderately positive as of the time of this posting. However, both social mood and news signal momentum indicate a high risk of trend reversal today or tomorrow.

Today’s social mood signal is +12.3 S&P points. Markets tend to follow social mood more often than not. Mood signal is moderately positive at the time of this posting, but momentum indicates a high chance of trend change today or tomorrow.

Today’s news signal is +13.9 S&P points. News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market. As of the time of this publication, the news signal is up, but news signal momentum indicates a high risk of trend reversal today or tomorrow. Yet, the huge divergence between news level and the stock market actuals indicate that extremely positive or extremely negative news could be very near.

Sunday, August 18, 2013

Violence and Volatility: Global Outlook Wk of 19 Aug '13

Social Mood patterns indicate a spike in factors related to violence and volatility. This pattern signals even more global violence and instability in the next few days. Markets continue to look shaky as the week begins. To add to the uncertainty, a short term trend change is near.

Update 8/23/2013: There definitely was a spike in global violence, with the primary example being the Syria chemical attack and the possible counterattacks currently on the table. In the markets, there was at least a short term trend change as the markets continued down into mid-day Wednesday and then climbed through Friday.

Update 8/23/2013: There definitely was a spike in global violence, with the primary example being the Syria chemical attack and the possible counterattacks currently on the table. In the markets, there was at least a short term trend change as the markets continued down into mid-day Wednesday and then climbed through Friday.

Labels:

august,

collective,

economic,

forecast,

global,

holistic,

instability,

model,

mood,

noetic,

prediction,

psychology,

science,

social,

socionomic,

stock market,

technical,

trading,

violence,

volatility

Subscribe to:

Posts (Atom)