after market update: actual S&P -10.2 (-0.6%); Markets started down about 1%, then climbed to near unchanged and then back down in a choppy fashion. Denial of the inevitable, and hope that there will be a last minute deal kept markets from falling further than they did.

News story that captured today's denial of irrationality theme almost exactly: The Republicans Fighting Obamacare Aren't Crazy

- - -

Overview: A U.S. government shutdown appears inevitable at this point, and the strongest negative influence is coming from the high uncertainty in the news. Social mood reflects a desperate pushing to disprove weakness or vulnerability, while the themes in the news reflect an active denial of appearing irrational or delusional. Markets could be confused and choppy, but most likely down.

Today's Market Outlook is Sharply Down to Near Unchanged (-0.2% to -0.8%). At the time of this posting, the social mood signal from over the weekend is slightly negative, and the signal from the news is strongly negative. Signal momentum indicates a choppy and confused market is possible today; although most likely down. The markets will likely stick closer to the news signal for the next few days.

News story that captured today's denial of irrationality theme almost exactly: The Republicans Fighting Obamacare Aren't Crazy

- - -

Overview: A U.S. government shutdown appears inevitable at this point, and the strongest negative influence is coming from the high uncertainty in the news. Social mood reflects a desperate pushing to disprove weakness or vulnerability, while the themes in the news reflect an active denial of appearing irrational or delusional. Markets could be confused and choppy, but most likely down.

Today's Market Outlook is Sharply Down to Near Unchanged (-0.2% to -0.8%). At the time of this posting, the social mood signal from over the weekend is slightly negative, and the signal from the news is strongly negative. Signal momentum indicates a choppy and confused market is possible today; although most likely down. The markets will likely stick closer to the news signal for the next few days.

Near term mood outlook: The social mood pattern corresponds with an agenda of disproving weakness or vulnerability. Common themes associated with the mood pattern found in the news are uncertainty, confusion, volatility, and trying to deny or disprove irrationality. The combined pattern, at times, accompanies global themes of violence, instability, and terrorist activity.

Near term market outlook: The social mood curve may be turning up. If so, a large market bounce could be due within a few days (would that also mean a U.S. government deal could be reached this week?).

Longer term outlook: The social mood trend has turned down, but not definitively. Confirmation of a continuation of the long term downtrend has not yet occurred.

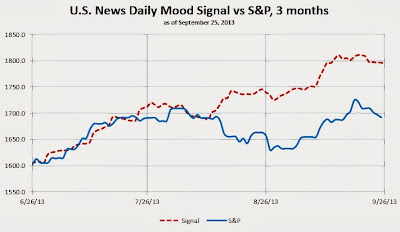

Today’s social mood signal is -12.1 S&P points (the entire weekend signal, Saturday thru Monday, is -3.1 S&P points). Markets tend to follow social mood more often than not. Signal is near support, the next few days are critical to direction.

(click to enlarge)

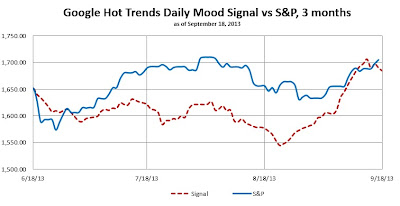

Today’s news signal is +3.5 S&P points (entire weekend signal, Saturday through today, is -13.2 S&P points). News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

Today's expected stock market range is calculated as -3.1 S&P points (weekend social mood signal) or -13.2 S&P points (weekend news signal) -0.2% to -0.8%.