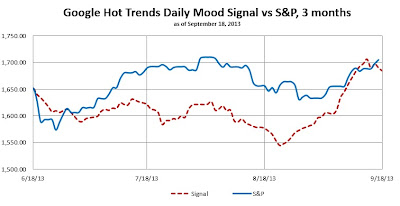

after market update: actual S&P +20.7 (+1.2%); FOMC announcement response was volatility and confusion, as they did what no one expected-- no tapering at all right now. The divergence between markets and social mood is not sustainable. Are people about to get really happy or are the markets about to drop sharply? The next few days could give us the answer.

Overview: Today is the much anticipated FOMC meeting that is supposed to begin tapering of quantitative easing. There are clues from social mood analysis as to what the likely response is today. Collective mood appears to have turned down; the markets should be close behind. Yet, in the early stages of a trend change there is often confusion and hesitation as forces pull in both directions, and people try to make sense of the changes they are perceiving. Today's stock market could be volatile and confused. Estimated gains / losses for today are nearly unchanged to down 1/3%.

Overview: Today is the much anticipated FOMC meeting that is supposed to begin tapering of quantitative easing. There are clues from social mood analysis as to what the likely response is today. Collective mood appears to have turned down; the markets should be close behind. Yet, in the early stages of a trend change there is often confusion and hesitation as forces pull in both directions, and people try to make sense of the changes they are perceiving. Today's stock market could be volatile and confused. Estimated gains / losses for today are nearly unchanged to down 1/3%.

Today's Market Outlook is Mixed to Down. The social mood signal is slightly negative as of the time of this posting, and the news signal is slightly positive.

Near term outlook: The social mood pattern corresponds with "the closing of a chapter." Common news themes associated with the current pattern are confusion and uncertainty. The combined pattern at times accompanies volatility, instability, and geopolitical or economic uncertainty.

Longer term outlook: The social mood trend appears to be turning down; the bounce over the last month may be complete.

Today’s social mood signal is -5.7 S&P points. Markets tend to follow social mood more often than not.

Today’s news signal is +5.6 S&P points. News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

(click to enlarge)

No comments:

Post a Comment