after market update: actual S&P -1.4 (-0.08%); Markets were little changed, but the VIX was up over 5%. This signals nervousness going into the weekend. We'll know by Monday if their fears pan out or not. Either way, something very serious is brewing that is likely to change our collective reality in a big way.

Today's Market Outlook is nearly unchanged to moderately up (0% to +0.8%). Both the social mood signal and the signal from themes in the news are positive. However, the signals over the last few days show a sharp downturn may be imminent. The projected stock market change for today is shown in the chart below.

Note: data for U.S. social mood are scores in eight MoodCompass categories of Google Hot Trends, data for news are scores of top Google U.S. news stories. Scores are converted to 4 inputs to the Market Mood Model. The output is a conversion of mood data to estimated S&P point change. Stock market data source: Google Finance. This is posted as a public service, and to enhance exposure to our research. It is not intended to be trading advice.

(click t enlarge)

- - -

Overview: Social mood is reflecting the combination of celebration with family and manic Gray Thursday shopping. The risk of protests and civil unrest is high. While this can be seen strongly showing up in places like Thailand, the full expression of this mood component may stay in check for another day or two in the U.S. Themes in the news are reflecting either a vulnerability to attack and/or economic downturn. Markets are likely to range from nearly unchanged to moderately up today. Watch for a news event that may drastically change our collective realities in the next few days.

Today's Market Outlook is nearly unchanged to moderately up (0% to +0.8%). Both the social mood signal and the signal from themes in the news are positive. However, the signals over the last few days show a sharp downturn may be imminent. The projected stock market change for today is shown in the chart below.

(click to enlarge)

Near term mood outlook: Social mood is reflecting confusion, greed, and group cohesion (i.e. Thanksgiving with family). The risk of protests and civil unrest is high, along with the possibility of terrorist activity. Themes in the news are reflecting either a vulnerability to attack and/or economic downturn. The combined pattern of news and social mood reflects a global ending of a chapter or paradigm.

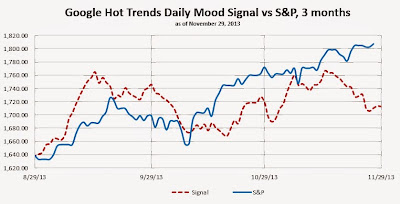

Near term market outlook: The social mood signal has broken below primary support (1760) which signals a serious downturn in social mood that is also likely to be followed by the markets.

Longer term outlook: The overall social mood trend has been in what appears to be a topping process for many months. There are no clear signals that this process will be over anytime soon. Yet, a sharp market drop of more than 15%, likely within the next few months, is indicated by long term mood and market charts.

Today’s social mood signal is +1.9 S&P points as of the time of this posting. On a daily basis, markets tend to follow social mood more often than not.

(click to enlarge)

Today’s news signal is +14.0 S&P points as of the time of this posting. News tends to follow the general trend of the market, but on a daily basis, can either lead or lag the movement of the market.

(click to enlarge)

No comments:

Post a Comment